Contents:

Use this spreadsheet to plot your current income against your expenses, and adjust your budget until it zeroes out. Using a personal budget template is helpful to get your budget started, though you can always personalize your budget to match your specific needs. Additionally, just because you create a budget one month, doesn’t mean your expenses and goals will be the same for the next. Be sure to have monthly check-ins on your budget and don’t hesitate to update it as your circumstances change. Plan how much money you need to save for your wedding, surface all applicable expenses, estimate overall costs, and establish a baseline spend goal.

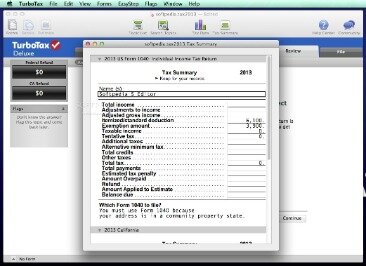

If your budget shows a projected loss, analyze your expenses and identify areas where you can reduce spending. Put this paper or spreadsheet away until after you have completed the next step. Though not as flexible as a separate template, there are many advantages to using the budgeting feature of your accounting software. To fully appreciate the power of the template, review the Summary tab after you have entered your budget figures.

- An annual business budget template offers a single or year-over-year comparison of expenditures compared to revenue.

- It is reported annually, quarterly or monthly as the case may be in the business entity's income statement/profit & loss account.

- After you tally your revenue and expenses, you can then calculate your profit and loss statement.

- The tables and graphs on this tab offer a visual representation of your income and expenses, making it easy to see where you stand at a glance.

- An effective small-business budget template is a living document.

For example, today’s world is so competitive, and numerous products and services are available in the market. Advertising and promotion are important ways to bring the attention of a customer. If there’s a surplus or deficit, you really need to know why. Either you over/under-budgeted, or perhaps individuals aren’t actually paying close attention to the budgets set out.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time.Try Smartsheet for free, today. This report is highly important for every organization to achieve its long-term goal. Proper training and skill must be given to employees for Budget report preparation. Most of the decisions of an organization are taken based on the Budgeted report. It focuses only on financial matters of the future; it does not provide other information such as consumer behavior, market conditions, or product quality. Proper training and skill are required to prepare the budget report.

Completed Sample Budgets

Maintaining a spreadsheet requires discipline, and creating a spreadsheet from scratch takes time. Save yourself the hassle of setting up rows, columns and formulas by using a pre-made Excel template from Office. Templates include a household expense budget, holiday budget planner and event budget.

WEEKLY REPORT: USING COUNCIL ALLOCATED FUNDS, CITY … – phlcouncil.com

WEEKLY REPORT: USING COUNCIL ALLOCATED FUNDS, CITY ….

Posted: Thu, 13 Apr 2023 07:00:00 GMT [source]

If income and expenses aren’t tracked and distributed properly, it could seriously impact your future. Using this monthly budgeting worksheet, you can ensure you’re financially secure when you retire. Track income sources as well as living, personal, and medical expenses on a weekly, bi-weekly, quarterly, or annual basis. You can also compare your actual income with what you need to retire comfortably. Of course, there are many different ways you can budget money, depending on your income source, family size, and the level of visibility you want into your finances. You may also want to create separate budgets for special purposes, such as retirement, college savings, or home improvements, in addition to your personal monthly budget.

Annual Startup Business Budget Template

Creating a personal budget is not only important for your financial well-being and peace-of-mind, but also for your short and long-term goals. Taking control of your finances with a personal budget template will help you make headway on these goals. Monthly or quarterly, compare your actual income and expense numbers to your budgeted numbers.

Obviously, the main role of almost any purchase journal is to see how the company performs against expectations. So if you forecast that your business will generate $10 million in monthly recurring revenue this quarter, this revenue may fuel your project budgets for the same period. This thorough worksheet prompts you to consider a wide range of expenses — from life insurance premiums to travel expenses to credit card payments — so you don’t miss anything.

The Sheets app for Drive includes pre-made templates, such as an annual budget and monthly budget. List your income and expenses, calculate spend and savings totals, and view which portion of income is going to which category of expenses to stay on top of your budget and ensure you don’t go over. Compare yearly budgets and set automatic alerts when you’re nearing your bottom line. The budgeting feature in your accounting software will coincide with your chart of accounts. Depending on the software you use, you can create a budget to actual comparison reports with the click of a button, making analysis a cinch.

Discover a collaborative, real-time way to manage your budgets. For example, you can potentially start a social media consulting business for less than $5,000. But a food truck business may necessitate a budget of at least $50,000. You must tailor your small-business budget to your unique needs.

Thank you for your insightful knowledge on the matter, it has brought me more understanding of budgeting. ZBB eradicates traditional expenditures that are no longer required. It is a strategic top-down approach re-evaluating every detail and decision. Businesses that are heavily reliant on employees need a systematic plan balancing revenue and wages. Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

Zero-Based Budget Spreadsheet

Content management Organize, manage, and review content production. Financial services Move faster, scale quickly, and improve efficiency. The scoring formula takes into account the type of card being reviewed and the card's rates, fees, rewards and other features. Allocate your budget to the portions of your business that need capital most. Compare the details of multiple financing offers to get your business funded faster. I have gained tremendously from your wealth of knowledge in this field.

City of Toronto releases two reports detailing progress on ambitious … – toronto.ca

City of Toronto releases two reports detailing progress on ambitious ….

Posted: Wed, 19 Apr 2023 14:25:07 GMT [source]

Maintaining a budget is especially important when running a business. Whether you offer goods or services, this monthly budget template can help put you on the road to success. Record business expenditures, such as advertising, taxes, and legal fees, and plot them against business income, such as product sales and service fees. This template shows you where you need to reduce or eliminate spending, and helps you identify your most profitable sources of income. Use this simple first-year budget calculator to determine whether your budding business has adequate resources to meet its financial obligations.

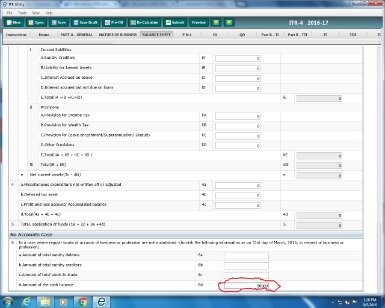

Example of Budget Report

This detailed template offers a summary of your income, expenses, and savings goals on one sheet with a detailed monthly breakdown by category on another. By taking a closer look at your budget, you can gain better control over your finances. Additionally, be sure to consider one-time costs in your annual business budget. Seasonal costs may also impact your budget, as well as any promotional events on which you plan to spend more on advertising or marketing campaigns to boost sales. These expenses can affect your business’s annual revenue projections. Use the preset criteria in an annual business budget template to determine the overhead and administrative costs related to your products or services and to make any adjustments.

- To achieve this target, the organization has to estimate 1000 units of production.

- This thorough worksheet prompts you to consider a wide range of expenses — from life insurance premiums to travel expenses to credit card payments — so you don’t miss anything.

- Be sure to have monthly check-ins on your budget and don’t hesitate to update it as your circumstances change.

Perhaps you’re interested in creating a budget for monthly business expenses or corporate projects. That’s why we created this comprehensive list of monthly budget templates. No matter what you’re budgeting for, this collection has a template to meet your needs. Whether you’re managing your family’s finances, running a business, tracking your personal spending, or planning for college, the costs can seem endless. Creating a monthly budget spreadsheet is a useful way to keep track of all these expenses and compare them with your income, so you can gain control over your finances. An annual business budget template allows you to enter planned salary, office space, marketing, training, and travel costs in order to calculate at your expense variance.

The Importance of a Personal Budget

Help your departmental teams track monthly actuals against budget goals so finance can tightly manage corporate financial performance and ensure business stays on track. Going through several months’ or even a year’s worth of accounting data or bank and credit card statements will ensure you capture all your spending. This is not the step where you want to try to eliminate expenses. Record everything, only excluding expenses you have already eliminated from your monthly or annual spending. PDFConverter.com has compiled a library of 15 small-business budget templates.

Billie Anne has been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization. In 2012, she started Pocket Protector Bookkeeping, a virtual bookkeeping and managerial accounting service for small businesses.

Household Expenses Monthly Budget

The budget report prepared in the current year might change due to rapid changes in the market. For example, suppose there is a demand for 1000 units, and the selling price per unit is $ 20. To achieve this target, the organization has to estimate 1000 units of production. It has to estimate how much labor cost and raw materials costs are needed to make the production cost per unit lower than $ 20 to maintain a profit. HB Publications provides a very straightforward budgeting control process.

Whether remodeling your home or building a new one, it’s easy for costs to get out of hand. Use this monthly budgeting worksheet to account for all labor and materials expenses, track spending by category, and ensure you’re within your overall budget. This template can also help you set aside extra funds for emergency repairs and unforeseen costs, which are common with construction projects. Check out these Excel construction management templates to help you manage a budget for larger jobs. Planning ahead is especially important when it comes to your retirement.

This all-purpose monthly budgeting spreadsheet can help you keep track of most personal and family expenditures. These can be tracked against your individual and/or family income, so you can make sure you’re prepared for the future. Gain a year-over-year perspective of annual revenue vs. expenses with this startup-specific annual business budget template.

If you have good spend management tools in place, this will be easy. They tell you exactly what was spent against each budget, in real time. Otherwise, accounting software like Xero works with expense management tools to the same effect. Budgeting reports (or simply “budget reports”) let companies compare their actual spending with what was budgeted for.

Director Rachel Rossi of the Office for Access to Justice Delivers … – Department of Justice

Director Rachel Rossi of the Office for Access to Justice Delivers ….

Posted: Fri, 21 Apr 2023 16:39:05 GMT [source]

It also identified how the company would achieve the sales target by acquiring new customers, business units, and segments. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

Which means that the budget can’t simply be exceeded by chance. In reality, you already know the value of great budget reports. Leaders can only make smart decisions with good data, and these reports are one such example. But once budgets are set, you can’t simply assume that they’re respected. And these reports are an opportunity to reflect on how money was deployed over each set period. Of course, creating the budgets themselves is a huge part of this exercise.

He has covered financial topics as an editor for more than a decade. Before joining NerdWallet, he served as senior editorial manager of QuinStreet's insurance sites and managing editor of Insure.com. In addition, he served as an online media manager for the University of Nevada, Reno.